Aero Mobility Platform

ST Engineering iDirect’s proven aero platform our core infrastructure and a comprehensive portfolio of products, technologies and capabilities, known collectively as ‘advanced mobility’. This suite of solutions solves the challenges that exist in bringing connectivity to an aircraft and create a winning service and business result for the airline customer.

Our aero platform offers choice and scalability to supply service providers with the technology necessary to meet the airlines’ varying requirements.

Bandwidth Management

Service providers use capacity from many beams and satellites to provide coverage for a fleet of aircraft. These distributed and complex networks could impact service consistency without proper bandwidth management. Bandwidth management selects and aggregates capacity. The resulting pool can be shared across aircraft, users and applications and it can be delineated by SLAs and other priorities to tailor for airline requirements.

The importance of global bandwidth management will only increase as new NGSO constellations and next-generation GEO satellites come online creating a step increase in the dynamic nature for beams.

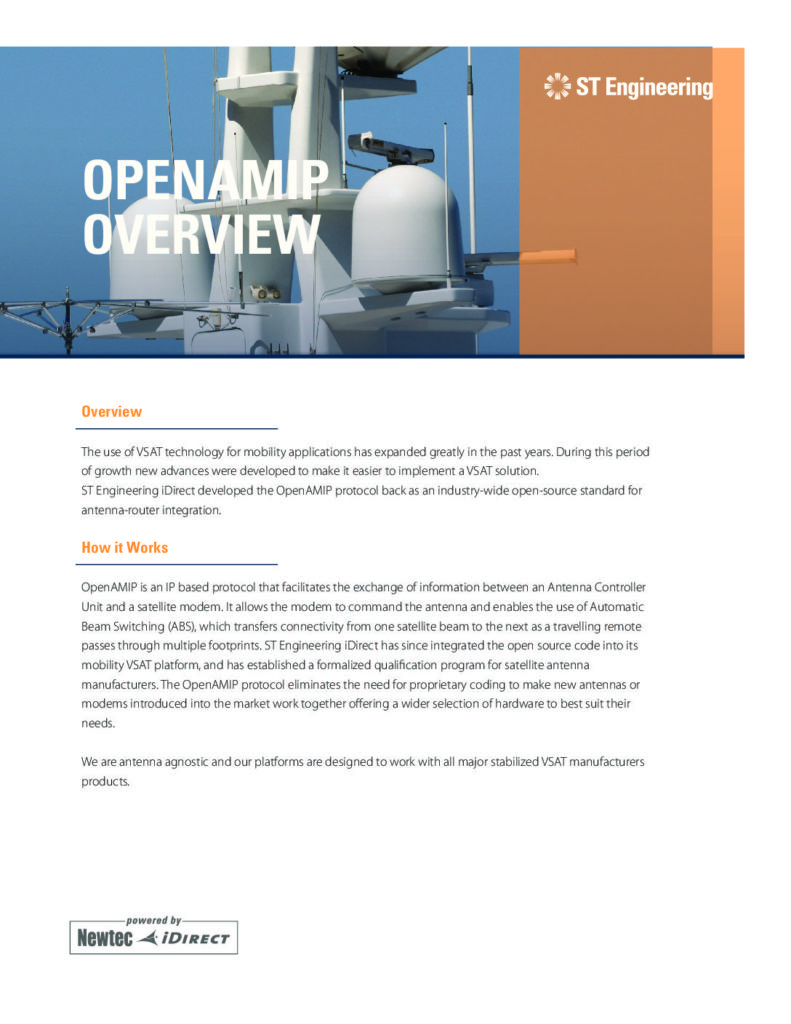

Beam Switching and Reacquisition

Modems onboard aircraft likely need to connect to multiple satellites and beams as they travel across airspace. This is known as beam-switching. It is essential to a seamless broadband experience. Beam switching and fast reacquisition keep signal interruptions imperceptible to passengers. Automatic beam switching that is built into the aero platform eliminates manual intervention as well as managing regulatory compliance.

API-driven platform features allow service providers to create new roles and new operation methodologies that continue to allow them to differentiate, using the platform in different ways. The same goes for QoS management including options to allow customers to customize their beam switching algorithms. This high level of customization adds up to a unique offering and, by extension, unique value that service providers can add for users.

Return Waveforms for Mobility

Waveforms are a basic element of satellite service, however today waveform innovation is opening and expanding markets with more options to achieve the most optimal use of bandwidth. Truly advanced mobility will leverage our pioneering approach to waveforms to enable the very highest throughput rates, the highest network availability, and to automatically adjust or optimize the satellite capacity.

Aero Modems Fit for Purpose

Our modems are specifically optimized for aero requirements in form factor, environmental adaptivity, performance and reliability. Ready for the rigorous supplemental type certificate (STC) process, our aero modems are the most widely supported – part of a comprehensive ecosystem among aero terminal integrators, network operators, and service providers – providing airlines the shortest time to deployment.

Customizable and Scalable

Our aero platform gives network operators and service providers to flexibly and cohesively orchestrate capacity as they add more and more aircraft to keep up with airline demand. Equally important, they are able to incorporate their own sophisticated tools and management around our flexible system to enable a unique portfolio of services.

Offering flexibility in the core network infrastructure allows airlines to reduce initial capex while staying nimble enough to scale up in line with demand. Modems offer software-defined architectures, allowing them to be continually upgraded over the air to increase network capabilities and throughput levels while dramatically extending the deployment life in the air.

Antenna and Terminal Innovation

We are working with several flat-panel antenna manufacturers who are producing smaller, thinner and more aerodynamic antennas. Our waveform technology integrated with the system controls help mitigate common satellite interference and enable satellite transmission to fast moving aircraft, while maintaining a reliable and efficient link.