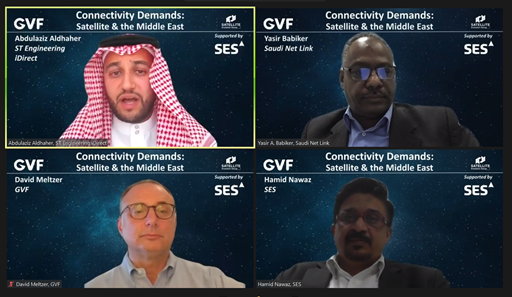

Our hunger for data is insatiable – and satellite-based solutions that offer flexible, high-bandwidth, low-latency, cloud-based services are becoming increasingly important. This is especially true for telcos and MNOs that are being challenged by this need for data and its management and analysis. What are the drivers for this growth and the barriers to connectivity in the region? A GVF webinar earlier this week, hosted by David Meltzer, set to work answering these questions and ST Engineering iDirect’s Abdulaziz Aldhaher was joined by Hamid Nawaz of SES and Yasir Awad Babiker of Saudi Net Link to bring this discussion to life.

Drivers for Data

Hamad Nawaz pointed out that 2020 saw a COVID-driven surge in Internet bandwidth which saw demand rise by 34 percent, a significant rise over 2019. Video and social media are being consumed like never before. Nawaz remarked that the average mobile data usage for the Middle East and Africa has risen to around 5.6 GB per month, per subscriber. With smartphone penetration rising exponentially, this is only set to continue. The need for vast volumes of data is being driven by over half of the world’s population along with the machines that support our way of life. During the pandemic, we experienced an uptake in tele-medicine, distance learning, and remote working. In addition to this, we continue to find new ways of utilizing technology to improve our standard of living. This includes applications to deliver our groceries, arrange transportation, trade stocks and many more data driven use cases.

The most significant drivers in the Middle East have been around Smart Cities, IoT use cases and extending connectivity to rural areas and schools. The analysis and management of this data allows us to apply predictive maintenance, improve operational efficiency and pave the way for autonomous applications.

Yasir Awad Babiker also noted that Saudi Internet Link is seeing “a significant migration from the traditional client server model and local computing to cloud services. This, combined with the COVID situation and the increase in business and schools moving to remote working is not a temporary transition, it means that this is going to be a permanent impact.”

What does this mean for MNOs?

For MNOs their priority is meeting KPIs and SLAs. They therefore must look for efficiency, performance, flexibility, and scalability. They need a reliable service they can use to easily extend connectivity to rural sites and integrate seamlessly within their terrestrial network. On top of that, cost efficiencies are also key to connect the lower average revenue per user (ARPU) regions that cannot afford costly buildouts. Scalability is also critical. High performance platforms that provide high efficiency and that leverage cost-effective frequency bands with high Quality of Service (QoS) will enable them to meet these requirements.

Terminals are also an important consideration for rural deployment as they must be at the right price point for the required throughput and the range of available terminals must also meet future needs.

With the help of favorable satellite economics, namely High Throughput Satellites (HTS), smaller antennas and more sophisticated bandwidth management tools the business case for satellite can be made. The combination of cheaper capacity prices and high-performance ground segment together with a reduction in RAN CAPEX makes the business case for MNOs expanding network coverage very attractive.

ST Engineering iDirect engaged in projects such as the Telecom Infrastructure Project (TIP) initiated by Facebook where we have learned that the best way to lower ARPU is with new, cost-effective technologies such as small cells and new and advanced satellite technologies as well as Open RAN or disaggregated RAN. It’s these kinds of developments that will facilitate a valid rural connectivity business case. In order for a competitive Total Cost of Ownership (TCO) to be achieved, all aspects related to OPEX, CAPEX, performance and even customer experience need to be taken into account to adhere to strict Service Level Agreements (SLAs) that MNOs will impose.

What about 5G?

The Middle East is in the midst of 5G rollout and in other regions of the world we see the same gradual rollouts happening. But how will the implementation of 5G technology proceed?

Hamid raised the point that there have been seven deployments in the last few months. Look at the C-band spectrum auction in the United States, as well as the increase in capital spending budget from major telcos such as Verizon and T-Mobile. As Hamid says: “The real money is being deployed now”. The pandemic also caused a re-evaluation of technologies as major industries had to adapt to lockdowns and remote working and the acceleration of digitalization. All three panelists agreed that 5G will be pivotal in in the future.

Addulazziz also stressed the importance of how we adopt standards-based technologies to fast-track innovations, taking well proven, fully adapted standards and working with bodies such as 3GPP that is defining the specifications for satellite.

We’re working on modernizing our architecture based on 5G, on NFV and SDN architecture principles, and we’re also developing proven network architectures that provide open APIs for end to end, network orchestration and business system integration across again multi orbital satellites, terrestrial and mobile networks.

Abdulaziz summed up by saying: “We’re geared towards that evolution, and that continued contribution to satellite backhaul, working very closely with our telcos in the region.”

IoT – How big is this market in the Middle East?

At ST Engineering iDirect we now offer new IoT Solutions with a pathway to satellite IoT by leveraging our existing Evolution, Dialog or Velocity hub infrastructure and pairing it with state-of-the-art, compact terminals and optimized IoT waveforms for low-throughput IoT use cases. These will all be on display at CABSAT from 26-28 October in Dubai.

Hamid Nawad also stressed the importance of a non-GEO approach for IoT: “…here is a need for high reliability, and much more cost-effective non-GEO offerings, and this is where we believe satellite will have a space in not only for the for the very remote areas but also on the peripheries of the urban centers.”

Yasir Awad Babiker also pointed out that satellite had been viewed as the final resort when there was no alternative to fiber connectivity. However, this view is changing. He said: “The major challenge for satellite was the very high cost of building and launching a satellite. Now we see very small satellites that cost 10 million or even less than that. The latency has been significantly changed from 500 milliseconds to sub 100 milliseconds. Now we can have tens of gigabits capacity and the same server life. So the cost has significantly been driven down.”

Future’s Bright for Satellite in the Middle East

David Meltzer concluded the Roundtable by summing up: “Technology markets have changed, and for the better from an MMO and telco perspective when it comes to utilizing satellite, and its unique ability to provide ubiquitous connectivity anywhere and anytime in a reliable manner.”

We’ll end with some final quotes from the panelists:

“We need to actually take the network onwards to the remote areas or to upgrade the network in order to get those additional revenue streams that is in their [MNOs] interests and in our interests. We want to take it to the next level of innovation in space, and with ground segment partners like ST Engineering iDirect, we would like to have a combined impact that which can drive the business growth of mobile.” – Hamid Nawaz

One of the strengths [of satellite] is that the supply can provide growth. Satellite can be deployed quickly and that means you can deploy it quickly for use at peak times. This is very critical for network operators….That means they are going to grow, and they are going to gain a lot more under market share. The infrastructure in terrestrial networks for remote areas is very expensive and satellite can provide a much lower cost, overall. The most important thing at the end is flexibility.” – Yasir Awad Babiker

“Satellite is no longer a take it or leave it scenario. Today, satellite offers a hugely flexible and much more affordable solution that can help MNOs to reach new subscribers regardless of where they are located.” – Abdulaziz Aldhaher

Watch the webinar: