By Terry Bleakley, Regional Vice President, APAC, ST Engineering iDirect

The Asia-Pacific (APAC) region has rapidly emerged as a critical hub in the global commercial satellite industry, distinguished by a large number of regional satellite operators and growing connectivity demands across diverse geographies.

The region’s satellite ecosystem is highly competitive, with over 20 regional operators alongside several global players actively providing services. This dense operator landscape has fostered a vibrant market characterized by rapid technological adoption and innovation.

A unique aspect of the APAC satellite market is the significant involvement of emerging economies investing heavily in satellite infrastructure as part of their national development strategies. Countries like Vietnam, Laos, and Bangladesh are launching domestic satellite programs and incentivizing local innovation ecosystems.

This policy-driven push helps build homegrown ground segment expertise and encourages partnerships with international vendors, accelerating technology transfer and fostering regional self-reliance.

However, whilst much attention centers on satellite constellations themselves, the ground segment – the network of gateways, antennas, network management systems, and related software – is a fundamental pillar supporting the effectiveness and scalability of satellite services.

Given APAC’s geographic diversity, including island nations, mountainous areas, and dense urban centers, ground infrastructure must be versatile, robust, and scalable to deliver reliable connectivity.

The evolution of ground infrastructure in APAC

Over the last five years, the APAC ground segment has evolved considerably. The widespread deployment of High Throughput Satellites (HTS) with frequency reuse and spot beam technologies has revolutionized satellite communications by dramatically increasing capacity and spectral efficiency.

However, these advancements come with increased ground infrastructure complexity. HTS systems require an expansion of gateways to handle the distributed coverage patterns, prompting satellite operators to significantly upgrade their ground networks.

Operators are challenged to deploy gateway networks that can serve vast urban populations and reach remote rural or island communities. This includes balancing centralized hubs with distributed ground stations, optimizing backhaul connections, and ensuring resilience to local environmental conditions such as tropical storms and high humidity.

An additional catalyst for ground segment evolution in APAC is the growing role of satellites in bridging the digital divide. Governments and private entities increasingly recognize satellite’s potential to provide broadband in underserved regions, which has driven investments in ground infrastructure that supports affordable, scalable connectivity. The APAC market offers fertile ground for innovation, with satellite systems increasingly integrated into national broadband strategies and telecom networks.

Impact of NGSOs and multi-orbit architectures on ground systems

The arrival of Non-Geostationary Satellite Orbit (NGSO) constellations, including Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) satellites, has further transformed ground segment requirements in APAC.

Unlike GEO satellites that remain fixed relative to ground points, NGSOs move rapidly across the sky, necessitating ground stations with advanced tracking capabilities and low latency switching.

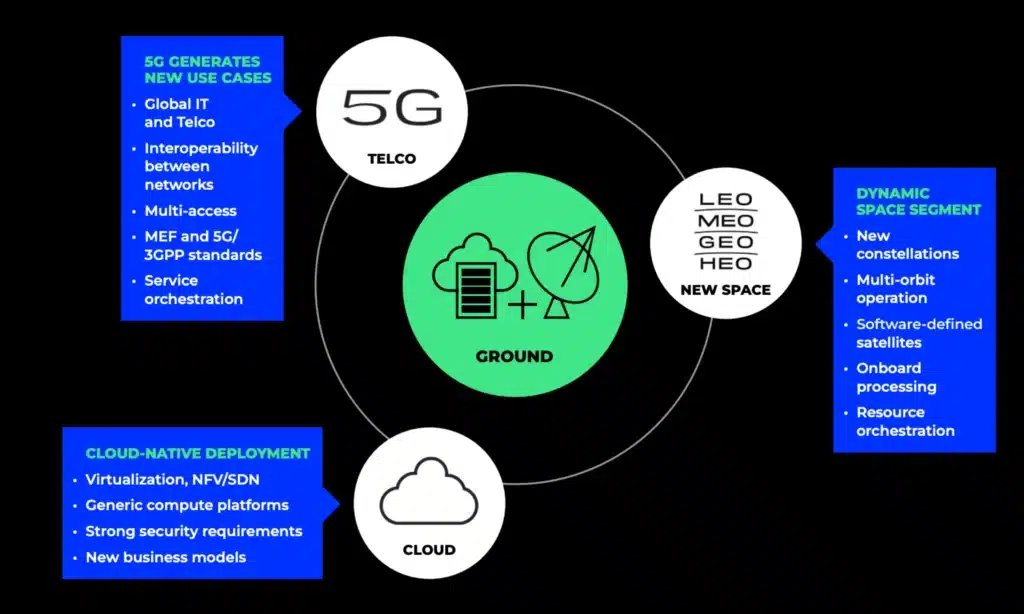

In response, the ground segment now incorporates electronically steerable antennas and more intelligent network orchestration systems to handle seamless handovers between satellites. Software-defined networking and network function virtualization have become critical to managing the complex, multi-orbit satellite ecosystems emerging across the region.

Operators are increasingly exploring partnerships and shared ground infrastructure to manage capital expenditures efficiently while expanding service footprints. This collaboration is a necessary evolution given the high costs and technical demands of tracking NGSO constellations.

However, given the large number of NGSO satellites planned or already launched over APAC, spectrum coordination has become increasingly complex. Operators and regulators in the region are working together to establish dynamic spectrum sharing frameworks and interference mitigation protocols, leveraging AI-based spectrum sensing technologies integrated within ground stations.

Unlocking scale

Historically, the satellite ground segment industry has been fragmented, with proprietary systems hindering interoperability and scalability. This siloed approach has limited the ability to rapidly deploy new services and integrate multiple satellite architectures efficiently.

A turning point is underway in the region as industry stakeholders begin to embrace standardization efforts. For the first time, satellite communications are being fully integrated into the global mobile network framework, facilitating the development of cost-effective, standardized ground equipment capable of supporting both terrestrial and satellite networks.

Industry consortia, such as the Metro Ethernet Forum (MEF), the Digital Intermediate Frequency Interoperability (DIFI) group, and the Wave Consortium are driving collaboration among ground segment vendors and satellite operators. These efforts aim to deliver modular, interoperable equipment that can flexibly support diverse satellite orbits and frequencies. This is critical in APAC, where the ability to serve different national and regional requirements efficiently can unlock significant market growth.

Virtualization and Software-Defined

Mirroring trends in the broader telecom sector, APAC’s satellite ground segment is shifting from hardware-centric systems toward software-defined architectures. Software-defined satellites (SDS) allow in-orbit reconfiguration of beam patterns and frequencies, but to fully realize their potential, ground infrastructure must also be agile and software-driven.

In this context, software-defined ground systems (SDGS) are becoming key enablers of operational flexibility. Virtualization allows remote provisioning, real-time network orchestration, and adaptive resource management. These capabilities support cost reduction, rapid service deployment, and tailored connectivity solutions across APAC’s varied geographies.

Cloud-native ground infrastructure also permits scalable deployment models. This is particularly relevant for smaller or emerging operators in the region who may lack the resources to build extensive physical ground networks.

The evolution of containerized cloud platforms within ground segments is particularly significant for APAC’s island nations, where physical infrastructure expansion is limited. Operators can deploy lightweight, virtualized network functions on cloud infrastructure located in regional data centers, minimizing the need for extensive local hardware.

Automation and AI in Ground Operations

As the region’s ground networks become more complex, automation and artificial intelligence (AI) are emerging as indispensable tools for operational efficiency. Managing hybrid constellations across GEO, MEO, and LEO orbits involves dynamic resource allocation, interference mitigation, and predictive maintenance – tasks ideally suited for AI-driven platforms.

AI algorithms can optimize beam steering, frequency use, and handover timing in real-time, reducing latency and maximizing throughput. They also enable proactive fault detection, minimizing downtime by predicting equipment failures before they occur.

These innovations are particularly valuable in APAC’s challenging environments where remote ground stations may have limited onsite technical support.

Regional influences guiding ground segment design

Island nations such as Indonesia and the Philippines require widely distributed, robust ground networks that can connect remote islands vulnerable to environmental extremes. This drives demand for compact ground terminals and resilient gateway designs.

Highly urbanized markets, such as Japan, South Korea, and Australia, focus on integrating satellite ground segments tightly with terrestrial 5G and fiber networks. This integration requires ground equipment capable of supporting high bandwidth and low latency, as well as compliance with stringent regulatory standards.

Emerging economies in Southeast Asia and the Pacific Islands view satellite as a critical enabler for closing connectivity gaps. For these markets, cost-effective ground segment solutions, such as modular, scalable gateways and GSaaS, are key to rapid network deployment and sustainable operations.

The challenges

Despite technological progress, deploying ground infrastructure in APAC faces several challenges. Regulatory environments vary widely, with spectrum allocation, gateway licensing, and cross-border data policies often differing country by country, and navigating these regulatory landscapes requires ground segment providers to work closely with national authorities and adapt designs accordingly.

Environmental factors also pose significant hurdles. Ground stations must withstand tropical cyclones, high humidity, and seismic activity prevalent across many APAC regions. Designing for resilience increases complexity and cost but is essential for reliable service delivery.

Capital expenditure remains a substantial barrier too, particularly for smaller operators and new entrants. While virtualization and GSaaS models reduce upfront investment, building and maintaining physical gateways with advanced tracking and beamforming capabilities demands significant funding. Innovative financing and public-private partnerships will be crucial to expand ground infrastructure equitably across APAC.

The road ahead

The APAC ground segment market is characterized by rapid technological advancement and growing regional demand. Integration with 5G NTN standards, virtualization, AI-powered automation, and collaborative industry initiatives are collectively reshaping the ground segment landscape.

As satellite constellations multiply and diversify, the need for flexible, scalable, and interoperable ground infrastructure becomes ever more critical. Ground segment providers that can deliver cost-effective solutions tailored to APAC’s unique geography and regulatory environment will be well positioned for growth.

Additionally, expanding satellite connectivity in maritime, aeronautical, rural broadband, and enterprise sectors will further drive demand for innovative ground stations and network management tools. The ability to support multi-orbit constellations and hybrid satellite-terrestrial networks will be a key success factor.

Overall, while satellites operate far above, the ground segment forms the essential foundation for realizing satellite connectivity’s promise in the Asia-Pacific region.

With continued innovation, standardization, and strategic investment, the APAC ground segment market is poised to flourish over the next decade, enabling digital inclusion and economic growth across a complex and dynamic landscape.