Last year, we kicked off our New Ground initiative, which aimed to highlight the critical role that ground systems play in the realization of New Space and to examine the transformations that are occurring in the industry.

As part of the campaign, together with Via Satellite magazine, we put out a survey to the industry that asked some of the key questions that are challenging our sector today as it positions itself within the new connectivity landscape.

There were around 700 respondents to the survey, from the industry itself and related sectors, including end users, governments and telcos and there was agreement that open satellite communications and 5G standardized ecosystems will provide end users with flexibility to integrate satcom and enable true heterogenous networks with roaming between satellite and terrestrial.

We’d like to explore the responses to some of the key questions and look at what it means for the future of the ground segment and our wider industry.

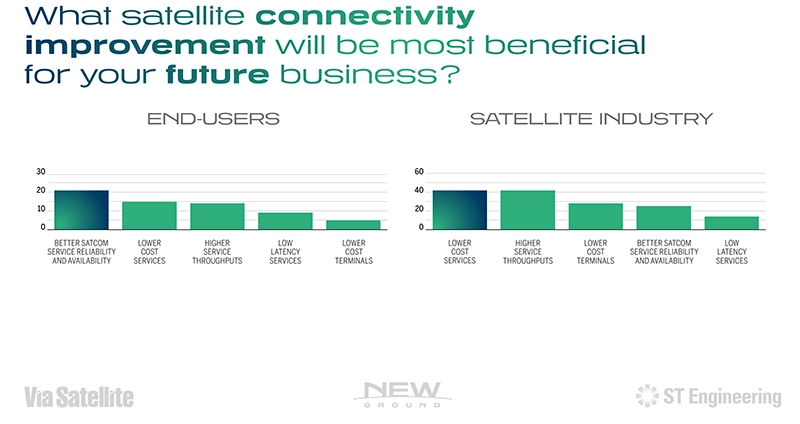

Which satellite connectivity improvement will be most beneficial for your future business?

For end users, cost was not the key concern. The main concern was better services over satellite. This is not surprising given the huge increase in bandwidth use that has occurred in the cruise and aero industries, for example, and the demand for ubiquitous bandwidth that can cater for all applications, including video.

Technology has evolved greatly over the last few years, but its impact takes time to be felt. Interestingly, latency is not a big concern for most of the applications, contrary to what new NGSO operators have been saying. For some, it is not as important as others, and satcom is already optimized to overcome the effects of GEO latency.

Another interesting response was around the topic of service quality with many new satellite entrants into the market focused on throughput and cost. However, it was clear that end users are not willing to compromise on service quality and SLAs.

ST Engineering iDirect’s focus on the delivery of high-quality services over satellite coupled with cost-effectiveness and throughput is aligned with both the end-user and industry view.

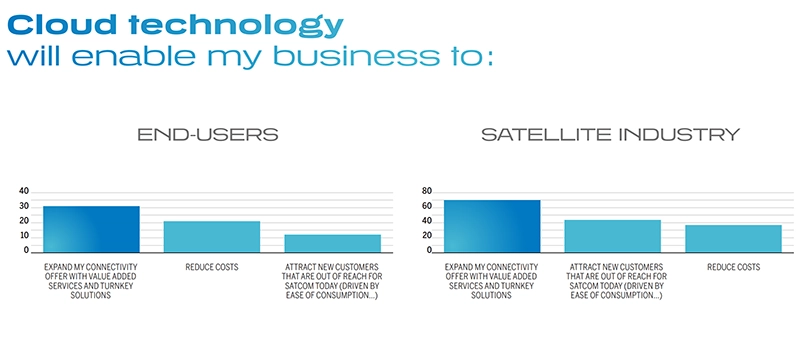

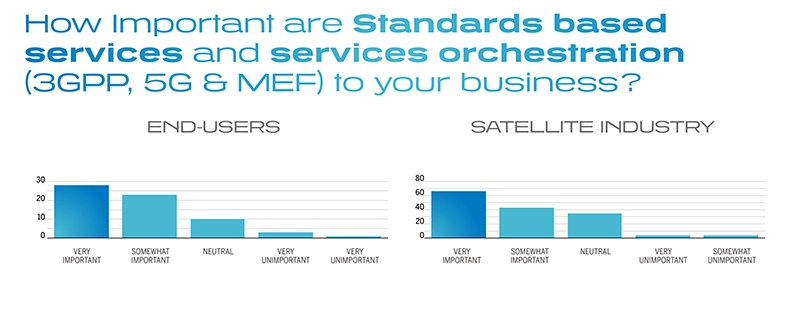

How important is cloud technology and virtualization to your business and how important are standards-based services and services orchestration (3GPP, 5G & MEF) to your business?

Just under half of all respondents agreed that the adoption of the cloud and virtualization is going to be important for their business. Here again, end user respondents were less concerned with reduction of costs and more about the expansion of connectivity services with added services and turnkey solutions. They expect cloud technology to expand connectivity offerings with value added services and turnkey solutions. Others say it will attract new customers that satcom does not reach today and reduce overall costs.

For satellite companies, this offers room for innovation and the need for value added services allows the expansion and optimization of remote operations, business processes and workflows, including the cloud, that can be deployed in locations connected by satellite.

Just under a third of respondents agreed that the adoption of standards is important to their businesses. Both end-users and the industry see 5G/3GPP as a key driver for seamless integration and delivery of satcom and terrestrial services. Such standardization will also allow the seamless delivery of advanced services over a mix of heterogenous networks where end-users will consume services from different networks.

The general consensus from respondents was that they are not concerned about how and when standards are available, they simply expect everything to work. As long as they are getting the services and quality they need, they are happy.

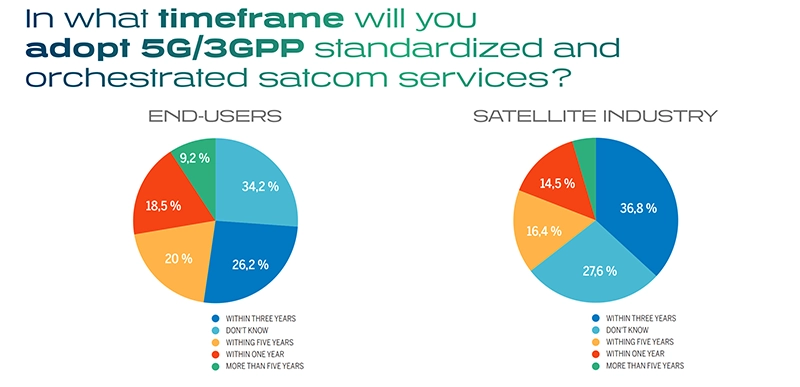

In what timeframe will you adopt 5G/3GPP standardized and orchestrated satcom services?

From the end user standpoint, around a third of respondents didn’t know when they would adopt standardized and orchestrated satcom services. Similarly, just under a third of the industry were also not sure. However, we must remember that it is completely normal for new technology to permeate and to become adopted.

Convergence of standards is also taking time on the terrestrial side. There is still a lot to learn about how we leverage standards and what benefits they will bring. There are some areas of the industry, such as operators, that will see those benefits immediately and will start work on adoption more quickly than others.

What are the challenges?

This convergence brings some concerns with it as well. The number one concern is that full standardization will create more cybersecurity risks for satcom services and this is in line with industry concerns on cybersecurity. Over a third of respondents said cyber hardening their networks and services is a top priority. Fewer worry that investing in 5G and cloud technologies is beyond their organization’s capabilities, or that their businesses will be challenged or displaced by new entrants.

Key Takeaways

The survey has turned up some valuable insights.

- End users see the value in satcom services and don’t want to compromise their experience and service capabilities for lower costs.

- High throughput services with SLAs and value-added services are very important for both the end users and the satellite industry.

- There is widespread recognition of the importance of the cloud and 5G/3GPP standardization as key enablers in our ability to achieve this.

Want to learn more about these fascinating results? Join us for a webinar that will take a deeper dive on the impact of ecosystem convergence with Euroconsult on October 13 at 3.30pm CET. Visit our Content Hub to discover more about New Ground.